Despite global turbulence Increased public spending is likely to drive economic activity in India: CareEdge

ANI

18 Mar 2025, 11:16 GMT+10

New Delhi [India], March 18 (ANI): While corporate performance remains below par, key factors such as recovering rural demand, lower income tax burden, falling food inflation, expected rate cuts, and increased public spending are likely to drive economic activity in the coming months according to a report by CareEdge Ratings.

However, external risks will require close monitoring, the global economy is facing significant turbulence due to an ongoing tariff war, causing fluctuations in growth, inflation, and financial markets, however, despite these challenges, Indian firms have shown improvement in sales and profitability in Q3 FY25.

The report highlights three major risks that could arise due to the global tariff war and its repercussions. Trade tariffs and retaliatory measures are expected to drive up global prices, limiting the Federal Reserve's ability to cut interest rates.

Elevated US interest rates will strengthen the dollar, leading to capital outflows from emerging markets like India, constraining the Reserve Bank of India's (RBI) ability to stabilize the rupee and reduce interest rates domestically.

Despite high capacity utilization in several sectors, the much-anticipated private investment recovery in India remains uncertain. Increased global trade pressures and competition from Chinese goods in non-US markets could push domestic manufacturers into a defensive strategy, focusing on protecting market share rather than expanding capacity.

US tariffs could prompt India to shift its import strategy, increasing direct imports from the US while reducing reliance on other nations. Multinational corporations may move production closer to home, reshaping global supply chains.

India could see growth in sectors like oil and gas imports, defence, and nuclear energy equipment. Higher freight and logistics costs may further contribute to inflationary pressures.

Despite these challenges, India has certain advantages that could help mitigate the negative impact of global uncertainties.

The recent 3-4 per cent depreciation of the rupee could provide Indian exporters with greater leverage when negotiating with US clients. India has opportunities to gain market share in sectors like electric vehicles and solar energy, where US tariffs on Chinese products have significantly increased.

Additionally, the government is actively working on a trade agreement with the US to secure tariff reductions for Indian exports while offering concessions where necessary.

The US's strategy to reclaim its manufacturing dominance through tariffs is expected to undergo multiple shifts before reaching a stable medium-term balance. Meanwhile, Indian firms will need to navigate these uncertainties strategically to sustain profitability and growth. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Hong Kong Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Hong Kong Herald.

More InformationChina

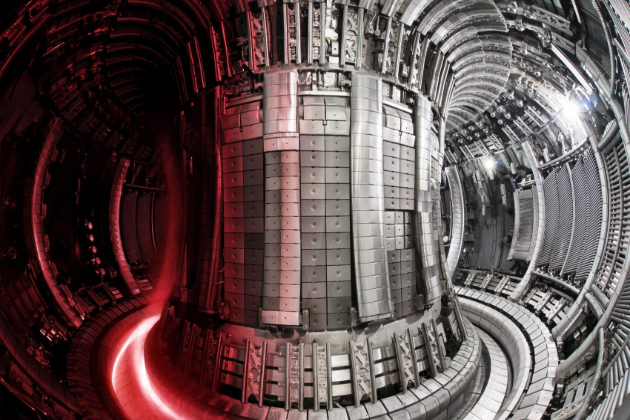

SectionVirginia governor warns US must fast-track fusion or fall behind China

NEW YORK CITY, New York: The U.S. must accelerate its efforts to develop fusion energy or risk losing its edge to China, Virginia Governor...

China now dominates shipbuilding; US faces security risks

WASHINGTON, D.C.: In the past 20 years, China has become the world's top shipbuilder, producing more than half of all commercial ships....

China hits Canadian agriculture with tariffs in trade retaliation

BEIJING, China: China has announced new tariffs on Canadian agricultural and food products in retaliation for Canada's recent duties...

Despite global turbulence Increased public spending is likely to drive economic activity in India: CareEdge

New Delhi [India], March 18 (ANI): While corporate performance remains below par, key factors such as recovering rural demand, lower...

Update: Xi stresses preserving distinctive culture in ethnic regions

GUIYANG, March 18 (Xinhua) -- Xi Jinping, general secretary of the Communist Party of China Central Committee, has stressed that areas...

Booming blueberry industry elevates SW China's Yunnan to global supplier

Workers package blueberries at a company in Mengzi of Honghe Hani and Yi Autonomous Prefecture, southwest China's Yunnan Province,...

Business

SectionVietnam, US sign energy and minerals deals amid trade talks

HANOI, Vietnam: As Vietnam seeks to strengthen trade ties and avoid potential U.S. tariffs, companies from both countries signed agreements...

U.S. and world stock markets swamped by buyers Monday

NEW YORK, New York - Profit-takers swooped on Wall Street and global markets Monday, buying up heavily-sold-off stocks. We're in a...

PepsiCo nears $1.5 billion deal to acquire Poppi

HARRISON, New York: PepsiCo is on the verge of expanding its portfolio with a major acquisition. The beverage giant is reportedly in...

Dollar General warns of slowing sales amid economic strain

GOODLETTSVILLE, Tennessee: Dollar General is bracing for a challenging year ahead, forecasting weaker-than-expected sales and profits...

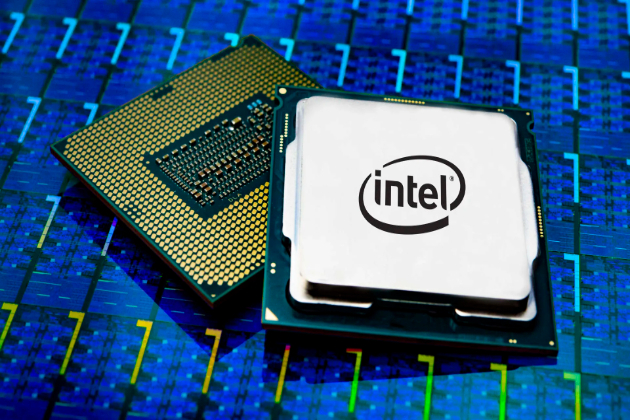

Intel stock jumps 15% as Lip-Bu Tan named CEO

SANTA CLARA, California: Intel's stock soared nearly 15 percent this week following the announcement that former board member Lip-Bu...

UAW files labor complaint as Volkswagen cuts Tennessee production

DETROIT, Michigan: Volkswagen's decision to scale back production at its Chattanooga, Tennessee plant has sparked backlash from the...