Margins of banks to moderate in FY25 and FY26, to rebound in FY27: Report

ANI

25 Jun 2025, 13:41 GMT+10

New Delhi [India], June 25 (ANI): Declining interest rates are not favourable for banks' net interest margins in the short term. According to a report by PhillipCapital, the net interest margins (NIM) of banks are going to moderate in FY25 and FY26, before rebounding in FY27.The report added that a 100 basis point cut in the repo rate and substantial liquidity in the system are conducive to deposit growth at cost-competitive rates.The Reserve Bank of India (RBI) has reduced the repo rate by 100 basis points since February 2025.The report highlights that Banks such as ICICI Bank, DCB Bank, AU SFB, and Axis Bank are expected to experience minimal impact on NIM compression, while others like HDFC Bank and SBI may see a moderate impact. Conversely, IIB and Bandhan Bank are projected to face the highest impact because of shifts in their loan mix.However, bank asset quality continues its upward trajectory, with stressed assets steadily declining across both private and public sector banks. As of FY25, credit costs are below the long-term average, reflecting improved underwriting standards and effective asset resolution.

While major stress events like the corporate NPA cycle and COVID-related surges in unsecured NPAs are largely in the past, some signs of stress persist in low-ticket unsecured loans. Early-stage microfinance stress has moderated, and credit card delinquencies appear to be peaking, suggesting a potential easing of credit costs ahead. Home loan asset quality remains stable, with Public Sector Banks (PSBs) increasing their market share in new originations.Similarly, vehicle loan stress remains contained, with stable metrics despite some early bucket increases in FY25.Furthermore, the PhillipCapital report also reveals that, credit demand is pegged at 1.1 times of the nominal GDP growth, with the sector's credit growth anticipated to be in the 11-12 per cent range for FY26. A notable pickup in unsecured retail loans is expected in the second half of FY26, driven by easing stress and improved borrower savings. Private banks, which previously lost market share in various retail segments, are likely to regain ground as credit risk subsides. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Hong Kong Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Hong Kong Herald.

More InformationChina

SectionMonsoon floods batter China, raising climate concerns

BEIJING, China: Extreme weather is once again testing China's resilience, as intensifying monsoon rains trigger floods across major...

TikTok gets US reprieve as Trump grants 90-day extension

WASHINGTON, D.C.: President Donald Trump has granted TikTok another reprieve, extending the deadline for its Chinese parent company,...

UBS: Over 379,000 Americans became millionaires last year

ZURICH, Switzerland: The U.S. saw an extraordinary rise in wealth last year, with more than 1,000 people crossing into millionaire...

US consumers cut back after early surge ahead of Trump tariffs

WASHINGTON, D.C.: Retail sales dropped sharply in May as consumer spending slowed after a strong start to the year, primarily due to...

CHINA-BEIJING-WANG HUNING-CPPCC-STANDING COMMITTEE SESSION-CONCLUSION (CN)

(250625) -- BEIJING, June 25, 2025 (Xinhua) -- Wang Huning, a member of the Standing Committee of the Political Bureau of the Communist...

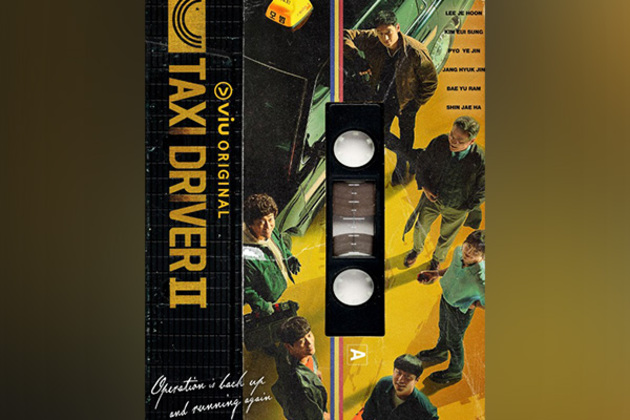

Korean Drama 'Taxi Driver 3' announced, actor Lee Je-hoon returns as vigilante driver

Washington DC [US], June 25 (ANI): Actor Lee Je-hoon is set to return for another ride as the vigilante taxi driver Kim Do-gi in 'Taxi...

Business

SectionToyota hikes US auto prices, says move is not tariff-driven

PLANO, Texas: Toyota Motor will raise prices across a range of vehicles in the United States starting next month, the Japanese automaker...

Tariffs, inflation raise stagflation risk as Fed eyes next move

WASHINGTON, D.C.: U.S. business activity showed signs of softening in June while inflationary pressures continued to build, driven...

U.S. stocks extend rally as Israel and Iran make peace

NEW YORK, New York - U.S. stock markest closed sharply higher on Tuesday as a truce entered into between Irsael and Iran after 12 days...

Meta unveils Oakley AI glasses as next step in wearable tech push

MENLO PARK, California: Meta is taking another swing at smart eyewear—this time with a sporty edge. The company announced a new partnership...

Markets rally on hopes Iran won’t disrupt oil flow

NEW YORK CITY, New York: U.S. stocks went up and oil prices fell this week as investors hoped that Iran would not block the global...

Water guns become symbol of anti-tourism anger in Barcelona

BARCELONA, Spain: Residents of Barcelona have devised a novel way to protest the presence of tourists in their city. Using a cheap...