Asian Bank Stocks Lead Market Drops After Collapse of 2 US Banks

Voice of America

14 Mar 2023, 14:37 GMT+10

Stock markets in Asia fell Tuesday, with shares of banks hit particularly hard, following a decline in U.S. markets amid the fallout from the collapse of two U.S. banks.

Japan's Nikkei 225 Index closed down 2.2% with shares of Softbank falling 4.1%, Mizuho Financial Group dropping 7.1% and Sumitomo Mitsui Financial Group sinking 9.8%. Hong Kong's Hang Seng Index closed down 2.4% Tuesday.

U.S President Joe Biden Monday sought to reassure Americans that the U.S. banking system is secure and that taxpayers would not bail out investors at California-based Silicon Valley Bank and the New York-based Signature Bank.

'Americans can have confidence the banking system is safe. Your deposits are safe,' Biden said in a five-minute statement delivered at the White House.

He said customers' deposits will be covered by funds banks routinely pay into a U.S. government-held account for such emergencies.

Biden vowed, 'We must get a full accounting of what happened' at the two banks.

US Moves to Contain Bank Failure Fallout

Despite the assurances, U.S. banks lost about $90 billion in stock market value on Monday as investors feared additional bank failures. The biggest losses came from midsize banks, of the size of Silicon Valley Bank.

While shares of the country's biggest banks - such as JP Morgan Chase, Citigroup and Bank of America - also fell Monday, the selloff was not as sharp. The huge banks have been strictly regulated since the 2008 financial crisis and have been repeatedly stress tested by regulators.

Biden ignored reporters' questions Monday about the cause of the U.S. bank failures, but financial experts say both banks were affected by a rise in interest rates, which negatively affected the market values of significant portions of their assets, such as bonds and mortgage-backed securities.

Banks don't lose money if they hold such notes until maturity. But if they must sell them to cover depositor withdrawals, as was the case in recent days, the losses can quickly mount.

India Tech Minister Plans to Meet Startups on SVB Fallout

The Federal Deposit Insurance Corp. reported that industrywide, U.S. banks at the end of last year reported $620 billion in such paper losses caused by rising interest rates.

The U.S. Federal Reserve, the country's central bank, announced Monday that it would review its oversight of Silicon Valley Bank in the wake of the bank's failure.

'We need to have humility and conduct a careful and thorough review of how we supervised and regulated this firm, and what we should learn from this experience,' said Fed vice chair for supervision Michael Barr.

The FDIC, which insures deposits up to $250,000 and supervises financial institutions, said Monday it transferred all Silicon Valley Bank deposits to a so-called 'bridge bank.' The new bank is run by a board appointed by the agency until it can stabilize operations.

The Bank of England also announced Monday the sale of Silicon Valley Bank's United Kingdom subsidiary to HSBC to stabilize the bank, 'ensuring the continuity of banking services, minimizing disruption to the U.K. technology sector and supporting confidence in the financial system.'

The actions were prompted by the failure of Silicon Valley Bank, which U.S. regulators seized on Friday after concerns about the bank's financial health led to a large number of depositors withdrawing their money at the same time.

Yellen: No Federal Bailout for Collapsed Silicon Valley Bank

With about $200 billion in assets, Silicon Valley Bank's failure was the second largest in U.S. history. The bank was heavily involved in financing for venture capital firms, especially in the tech sector.

Signature Bank also had a large portion of clients in the tech sector, including cryptocurrency. Its failure, with more than $100 billion in assets, was the third largest in U.S. history, behind Washington Mutual and Silicon Valley Bank.

Some information for this story came from The Associated Press, Agence France-Presse and Reuters.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Hong Kong Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Hong Kong Herald.

More InformationChina

SectionWH Chief of Staff Susie Wiles targeted in identity scam, report says

WASHINGTON, D.C.: U.S. federal officials are looking into an attempt by someone who pretended to be White House Chief of Staff Susie...

Chemical plant blast in eastern China kills 5, injures 19; 6 missing

BEIJING, China: Six people are still missing and rescue teams continued their search on May 28 after a powerful explosion at a chemical...

US optimism rises after tariff pause, survey shows

WASHINGTON, D.C.: After months of steady decline, U.S. consumer confidence saw a significant rebound in May—buoyed in part by a temporary...

Volvo cuts 3,000 jobs amid trade tensions and economic uncertainty

FRANKFURT, Germany: Volvo Cars, based in Sweden, is cutting 3,000 jobs to reduce costs as the automobile industry struggles with trade...

China’s GAC launches in Brazil as EV demand accelerates

SAO PAULO, Brazil: Amid a surge in electric vehicle (EV) adoption and growing competition in Brazil, Chinese automaker GAC has officially...

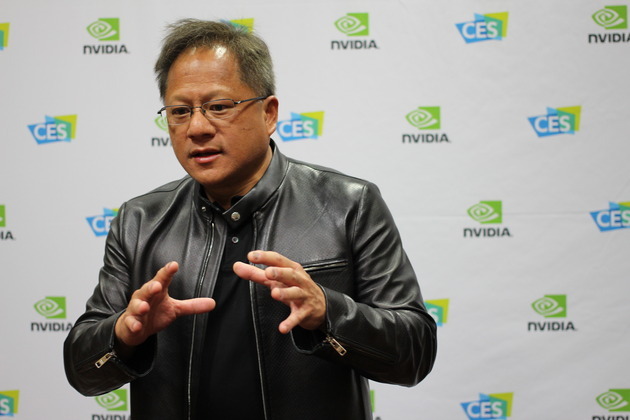

Nvidia targets China’s data market with new AI chip

BEIJING/TAIPEI: Facing mounting U.S. export restrictions, Nvidia is preparing to launch a new, lower-cost artificial intelligence chip...

Business

SectionElf beauty buys Hailey Bieber's Rhode in $1 billion Deal

LOS ANGELES, California: Model Hailey Bieber's skincare and makeup brand, Rhode, is being bought by Elf Beauty for around US$1 billion....

Airbus delivery delays now stretch to 2028, airlines warned

PARIS, France: Aircraft delivery delays at Airbus are now expected to stretch into 2028, as the European planemaker continues to grapple...

GameStop makes $513 million bitcoin bet in digital asset shift

GRAPEVINE, Texas: GameStop has taken a significant step into the world of cryptocurrencies, revealing this week that it has purchased...

US housing outlook dims as buyers await lower rates, BofA finds

NEW YORK CITY, New York: Rising mortgage rates and economic uncertainty are leaving many Americans unsure about whether to buy a home—just...

Texas bill targets app store access for minors, awaits governor’s nod

SAN FRANCISCO, California: Texas is set to become the first major U.S. state to require Apple and Google to verify the age of users...

US optimism rises after tariff pause, survey shows

WASHINGTON, D.C.: After months of steady decline, U.S. consumer confidence saw a significant rebound in May—buoyed in part by a temporary...