China Evergrande falls short of promised restructuring plan: Report

ANI

31 Jul 2022, 18:07 GMT+10

Beijing [China], July 31 (ANI): China Evergrande Group, one of the largest property developers in the country by sales has said that it will unveil the restructuring plan within 2022, amid the constantly drowning economy due to the COVID-19 pandemic.

Earlier, the troubled property developer had promised to release an initial restructuring plan by the end of July, according to The Wall Street Journal.

Sketching out the first contours of a long-awaited restructuring plan, Evergrande Group has stated that creditors could end up with debts directly backed by some of its most valuable assets outside of China.

As of June 2021, Evergrande had more than USD 300 billion in debt and other liabilities, such as unpaid bills to suppliers. It defaulted on its dollar bonds in December, after months of liquidity problems, it reported further.

On Friday, the group said that the sales of apartments have contracted totaled the equivalent of about USD 1.8 billion in the first half of this year--a roughly 97 per cent year-over-year drop, The Wall Street Journal reported.

Citing sources, the media outlet reported that Evergrande is expected to reach an agreement in principle with key creditors before the Chinese Communist Party's 20th Party Congress later this year.

China's ailing property market is one of its biggest economic headaches and Chinese authorities have been involved in trying to defuse risks at Evergrande.

Ron Thompson, a Hong Kong-based managing director at AlvarezMarsal as quoted by The Wall Street Journal said that the active role played by the Chinese government in debt restructurings, such as Evergrande's, could weigh on the sum bondholders ultimately recover, relative to the debt's face value.

"The reality is when the Chinese government is involved in a big restructuring process like this, I generally trust that the process will be fair, but not necessarily 100 per cent commercial and the visibility of the process might not be as high," said Thompson, who leads the firm's Asia restructuring practice.

Evergrande said it would take a relatively long time for its businesses and asset values to recover, due to property market turmoil in parts of China and the sheer size of its balance sheet.

Recently, some of Evergrande's largest creditors has demanded further details on the episode, which had prompted the ouster of Evergrande's longstanding chief executive.

Overseas bondholders will likely be placed at a lower priority when claiming assets in China, as is the case with many cross-border debt restructurings, saidDennis Kwok, a partner at New York-based Elliott Kwok LevineJaroslaw LLP. Kwok, a former Hong Kong lawmaker, is experienced in cross-border bankruptcy proceedings.

He said as quoted by The Wall Street Journal: "Overseas bondholders will likely be placed at a lower priority when claiming assets in China, as is the case with many cross-border debt restructurings".

In May, Chinese Premier Li Keqiang underlined the importance of implementing policies for stabilising the economy and supporting market entities to bring the situation back to the normal track in an unusually stark warning that comes as COVID curbs have adversely impacted the second-largest economy.

Keqiang had painted a grim picture of the job market in the world's most populous nation due to COVID-19 lockdowns. He had called the employment situation "complex and grave."He instructed all levels of government to prioritize measures to boost jobs and maintain stability, CNN reported. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Hong Kong Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Hong Kong Herald.

More InformationChina

SectionBeijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

UN climate agency gets 10 percent boost amid global budget cuts

BONN, Germany: Despite widespread belt-tightening across the United Nations, nearly 200 countries agreed this week to increase the...

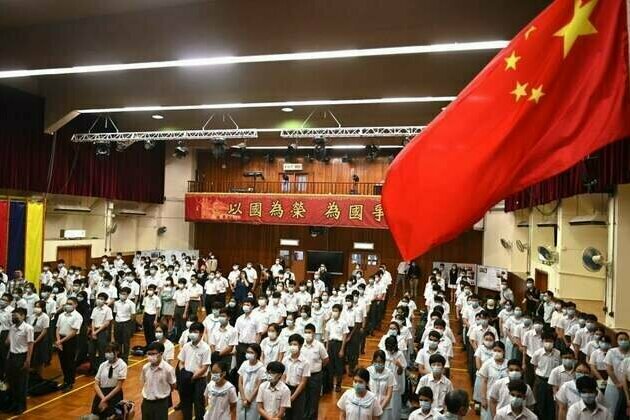

China: Building a 'Patriots Only' Hong Kong

(New York) - China's government has erased Hong Kong's freedoms since imposing the draconian National Security Law on June 30, 2020,...

Business

SectionWall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...

Taliban seeks tourism revival despite safety, rights concerns

KABUL, Afghanistan: Afghanistan, long associated with war and instability, is quietly trying to rebrand itself as a destination for...

Nvidia execs sell $1 billion in stock as AI boom drives record prices

SANTA CLARA, California: Executives at Nvidia have quietly been cashing in on the AI frenzy. According to a report by the Financial...

Tech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...