Aspen reports declining earnings after 'challenging' year

News24

12 Sep 2019, 02:13 GMT+10

Pharmaceutical company Aspen's [JSE:APN] net profit declined 14% as the group disposed of some of its businesses during the period as part of its strategic review to focus on pharmaceuticals.

The pharma group on Wednesday released its financial results for the year ended June 2019.

While revenue increased slightly by 1% to R38.9bn, normalised earnings before interest, taxation, depreciation and amortisation was 4% lower at R10.8bn due to weaker results from the group's manufacturing businesses. Operating profit took a 35% dip to R5.5bn. Higher net financing costs also contributed to an 8% decline in normalized headline earnings to R6.5bn.

Normalised headline earnings per share was 7% lower at R14.14. Net profit was down 14% from R8.3bn reported in the previous year to R7.07bn.

During the period the group announced a strategic review of its European and South African commercial businesses to be more "market-focused", according to the board's statement in the financial report. While the review of the group's European commercial business is ongoing, the South African business review has been completed.

In the closing six months of the year the group completed the disposal of its Nutritionals Business and a portfolio of products which are distributed in Asia Pacific. The disposal translated into cash proceeds of R12.3bn (before tax) and a combined profit on disposal of R5.4bn. The proceeds from disposals have helped reduce net borrowings from R53.5bn, as reported on December 31, 2018 to R39bn by year-end.

Aspen rockets after good news on debt

"While the past year has presented its challenges, we have achieved most of our short-term goals.

"The completion of the disposals of the Nutritionals Business and the non-core product portfolio has allowed us to fully focus on our core pharmaceuticals business," the board said in the financial report.

The board elected not to declare a dividend. "Taking into account our prioritisation of deleveraging the balance sheet, existing debt service commitments during the 2020 financial year and the short-term requirements of the ongoing capital projects, notice is hereby given that the board has decided that it would not be prudent to declare a dividend at this time," the statement read.

"The board will re-evaluate the relevant circumstances regularly with a view to declaring a dividend when it is considered prudent to do so."

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Hong Kong Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Hong Kong Herald.

More InformationChina

SectionDeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

UN climate agency gets 10 percent boost amid global budget cuts

BONN, Germany: Despite widespread belt-tightening across the United Nations, nearly 200 countries agreed this week to increase the...

Starbucks refutes media report on plans to exit China

SEATTLE, Washington: U.S. coffee company Starbucks has said it is not planning to sell all of its business in China, even though a...

How Chinese vapes reach US stores despite import restrictions

LONDON/NEW YORK/CHICAGO: In suburban Chicago, just 15 minutes from O'Hare International Airport, a small customs brokerage quietly...

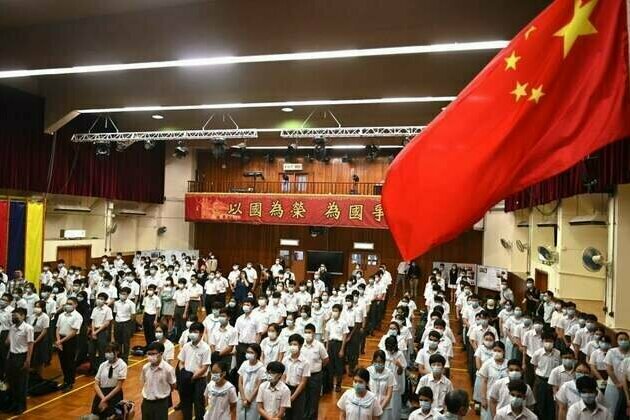

China: Building a 'Patriots Only' Hong Kong

(New York) - China's government has erased Hong Kong's freedoms since imposing the draconian National Security Law on June 30, 2020,...

Business

SectionWall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...